No Credit Score? Get A Mortgage With Manual Underwriting

Can you still chase the dream of homeownership even if your credit score is a blank slate? The answer, surprisingly, is a resounding yes, thanks to the often-overlooked process of manual underwriting.

The journey to securing a mortgage can feel daunting, particularly for those who haven't yet built a credit history. Traditional lenders lean heavily on credit scores to gauge risk, making it seemingly impossible to get approved without a robust credit profile. However, this isn't the only path. While applicants without a credit score face the same fundamental guidelines as any other borrower things like income verification and debt-to-income ratio considerations the good news is that alternative solutions exist. Several mortgage products are specifically designed for individuals with limited or no credit, and these often rely on a different, more personalized approach to assessing risk.

For further insight into manual underwriting, here's a table with useful information.

| Category | Details |

|---|---|

| Definition of Manual Underwriting | A process where a loan officer or underwriter reviews a mortgage application by hand, rather than relying on automated systems. This approach allows for a more in-depth look at a borrower's financial situation. |

| Key Features |

|

| Benefits |

|

| Who It's For |

|

| Alternative Credit Data Considered |

|

| Documentation Required |

|

| Process Overview |

|

| Factors That Impact Approval |

|

| Down Payment Requirements |

|

| Types of Loans Suitable for Manual Underwriting |

|

| Where to Find Manual Underwriting Services |

|

| Reference Website | Federal Trade Commission (FTC) |

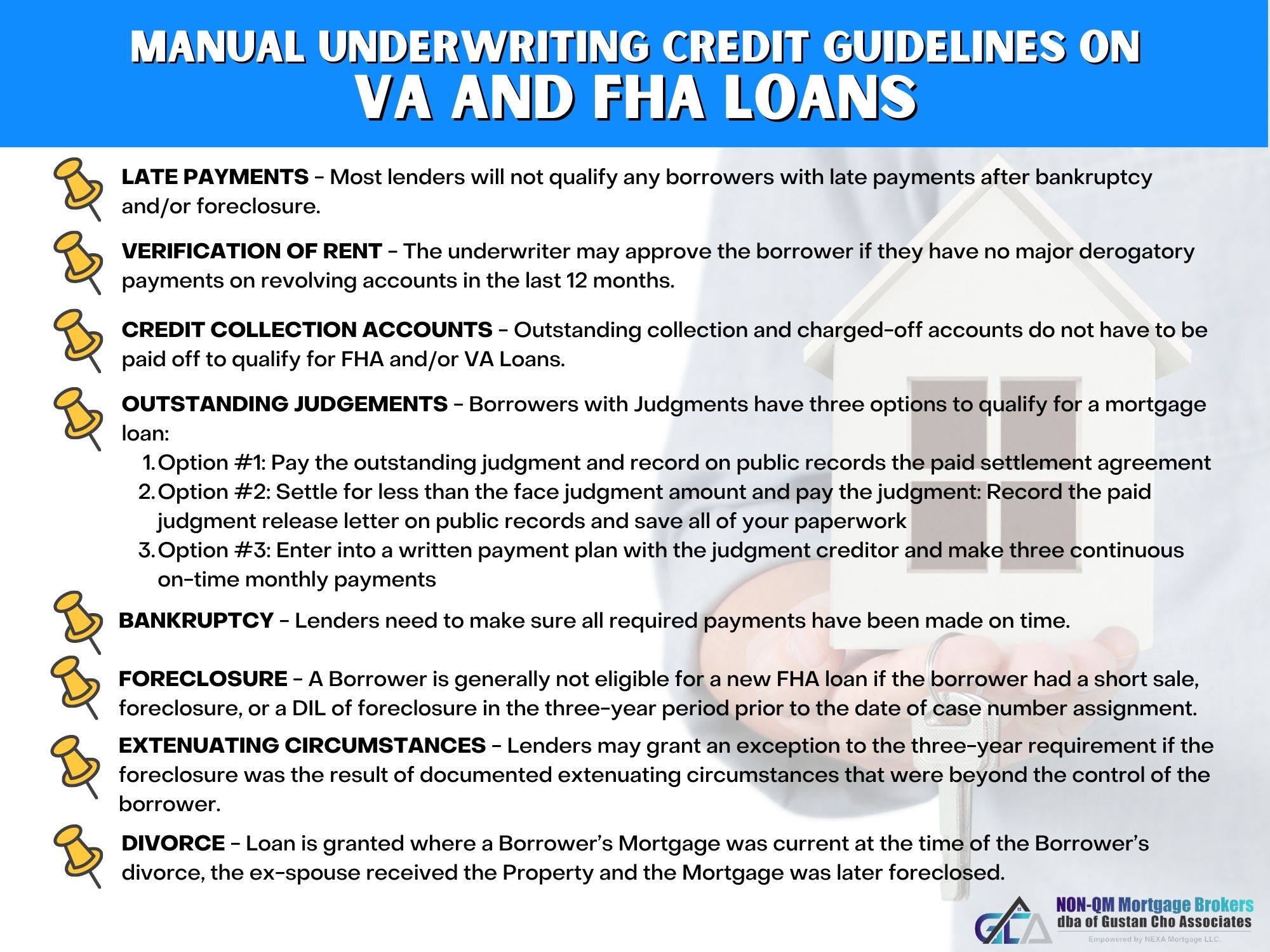

Manual underwriting is a critical alternative for individuals with no credit score or a limited credit history. Its a human-centric approach that assesses your ability to repay a loan by considering your whole financial story. Traditional lending practices have relied heavily on credit scores, this can be a significant barrier for those just starting their financial journey or who have had financial setbacks. The process involves a detailed evaluation of your finances, going beyond the narrow focus of a credit report. This might involve the careful examination of bank statements, employment records, and documentation of your payment history, such as for rent, utilities, and insurance.

The central concept is simple: if you can demonstrate responsible financial behavior through other means, you can still get a mortgage. This means a lender will look closely at factors like your income, employment stability, and your overall debt-to-income ratio (DTI).

For those with limited credit, manual underwriting can be a lifeline. The loan officer, in this process, will painstakingly review your application by hand, which is a stark contrast to the automated systems used by many lenders. The emphasis shifts to a more nuanced understanding of your financial profile, potentially opening doors to homeownership that might otherwise remain closed. It's worth remembering that not every lender provides manual underwriting for 'no score' loans, and it's often crucial to find a lender specializing in this area. Churchill Mortgage, for example, is recognized for its expertise in no-score loans and offers manual underwriting for customers.

The benefits of this approach extend beyond mere loan approval. It builds a direct relationship with the lender, allowing you to explain your situation and put a complete story behind your application. Manual underwriters can consider alternative forms of credit, understanding factors like rent payments or utility bills, which arent typically factored into a standard credit score.

However, it is essential to recognize that manual underwriting is not a quick fix. It's a more labor-intensive process than automated underwriting, requiring thorough documentation and a high degree of cooperation with your lender. The requirements can be quite specific, and the documentation is the most critical component. Providing bank statements, pay stubs, and proof of payments for recurring expenses are all crucial steps.

You may have heard about FHA loans and their relaxed credit score requirements. FHA loans can be an option for those with a credit score of 580, but it is crucial to remember that lenders can submit loan case files to DU (Desktop Underwriter) even when a borrower has no credit score. If a borrower lacks a credit score but has at least one credit or installment account on their credit report, the lender will use this information to assess the risk, and standard eligibility guidelines will apply.

What about the potential challenges? One potential obstacle is the mindset of the mortgage broker, who might recommend going the traditional credit score route instead. But by being persistent and well-prepared, you can advocate for yourself and your goals. It is important to understand that some mortgage products, and some lenders, may need a higher down payment if your credit score is on the lower end of the spectrum.

Manual underwriting takes a much deeper look at your financial profile than just your credit report. Instead of solely focusing on your credit score, the lender looks through your payment history, looking at documentation such as rent, utilities and insurance payments, to determine your ability to pay back your mortgage. If you lack a credit history, manual underwriting considers other factors that an automated underwriting system might reject, providing a more balanced, complete picture of your financial health.

Many people ask, 'Was going through the manual underwriting process worth it?' The answer is individual. For some, the most significant hurdle may have been the initial resistance from the mortgage broker who wanted to focus on the credit score route. But ultimately, for those who qualify and are willing to be patient, the benefits of homeownership can outweigh the challenges.

In essence, manual underwriting opens the door to homeownership for a whole segment of the population previously locked out by rigid credit score requirements. If youre committed to building a financial future, even without an established credit history, manual underwriting offers a viable path.