Understanding CVV Code American Express: Your Comprehensive Guide

In today's digital world, understanding the CVV code American Express is essential for secure transactions. Whether you're shopping online or making reservations, the CVV code plays a crucial role in verifying your card's authenticity. It ensures that your financial information remains protected while allowing seamless payment processes.

The CVV code, or Card Verification Value, is a security feature designed to prevent fraud and unauthorized transactions. For American Express users, knowing how this code works and its significance can enhance your overall payment experience. This guide will walk you through everything you need to know about CVV codes and their role in safeguarding your financial data.

As we delve deeper into the topic, you'll discover the importance of the CVV code American Express, how it differs from other card providers, and practical tips to keep your transactions secure. By the end of this article, you'll have a clear understanding of how to use this feature effectively and responsibly.

Read also:Free Online Remoteiot Display Chart The Ultimate Guide

Table of Contents

- What is CVV Code?

- CVV Code American Express Explained

- Where is the CVV Code Located?

- The Role of CVV in Security

- Differences Between CVV Codes Across Card Providers

- How to Use CVV Code Safely

- Tips to Avoid CVV Fraud

- Common Questions About CVV Code American Express

- The Future of CVV Technology

- Conclusion

What is CVV Code?

The CVV code, short for Card Verification Value, is a security feature found on all major credit and debit cards. Its primary purpose is to verify that the cardholder has the physical card during transactions. For online or over-the-phone purchases, where the card isn't physically present, the CVV code serves as an additional layer of protection against fraudulent activities.

This three- or four-digit code is unique to each card and cannot be stored by merchants after a transaction. Its random generation makes it difficult for fraudsters to guess or replicate, ensuring that only authorized users can access the card's funds.

Why is CVV Important?

- Prevents unauthorized transactions.

- Protects against identity theft.

- Ensures secure online payments.

By incorporating the CVV code into your payment routine, you contribute to a safer and more reliable financial ecosystem. Next, let's explore how this applies specifically to American Express cards.

CVV Code American Express Explained

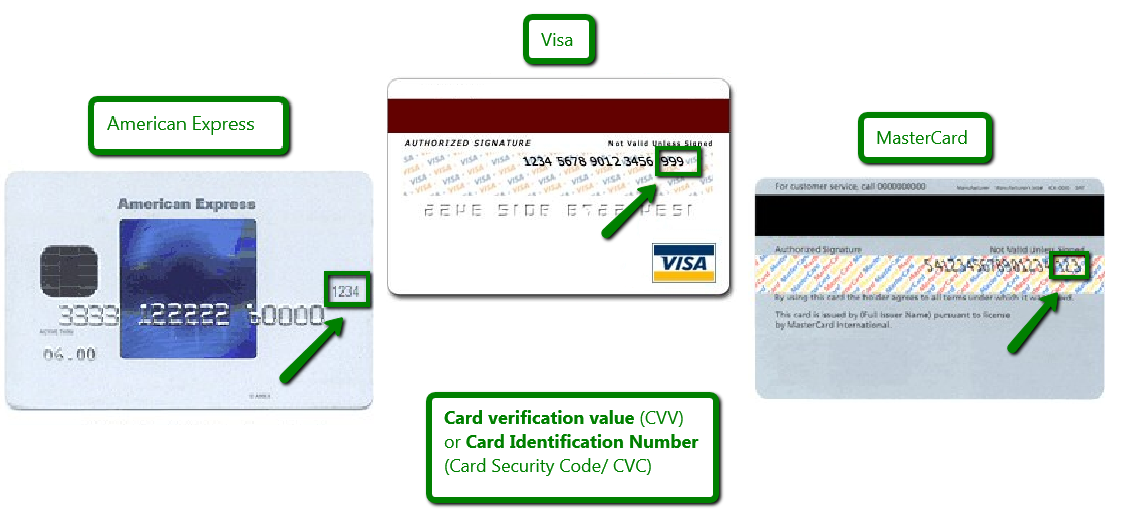

When it comes to American Express, the CVV code is referred to as the CID (Card Identification Number). Unlike Visa and MasterCard, which typically use three-digit codes, American Express employs a four-digit CID. This difference is one of the distinguishing features of AmEx cards and is important for users to recognize.

Understanding the CVV code American Express is crucial, especially for those who frequently engage in international transactions or use multiple card providers. The added digit enhances security measures, making it harder for fraudsters to counterfeit the card.

Key Characteristics of American Express CVV

- Four-digit code instead of three.

- Located on the front of the card.

- Printed above the card number.

This design choice reflects American Express's commitment to innovation and security in the payment industry. Let's now examine where exactly you can locate the CVV code on your card.

Read also:Is Henry Cavill The Next James Bond Speculations Facts And Insights

Where is the CVV Code Located?

Knowing where to find the CVV code is essential for using it correctly. For American Express cards, the CVV code is located on the front of the card, above the embossed card number. This placement differs from Visa and MasterCard, which typically display the CVV code on the back, near the signature strip.

While the location may vary depending on the card issuer, American Express consistently places the CID in a visible and accessible spot. This ensures that users can easily locate it when needed, without confusion or delay.

Steps to Locate Your CVV Code

- Flip your card to the front side.

- Look for the embossed card number.

- Find the four-digit code printed above it.

By following these simple steps, you can quickly identify the CVV code on your American Express card. Now, let's explore how this feature contributes to transaction security.

The Role of CVV in Security

The CVV code plays a vital role in enhancing the security of your financial transactions. By requiring the CVV during online or card-not-present purchases, merchants can verify that the person making the payment has the physical card in their possession. This significantly reduces the risk of fraud and unauthorized charges.

Merchants are prohibited from storing the CVV code after a transaction, further protecting your sensitive information. This practice aligns with industry standards and regulations, ensuring that your data remains confidential and secure.

How CVV Prevents Fraud

- Verifies cardholder identity.

- Prevents unauthorized use of stolen card numbers.

- Protects against phishing attempts.

These security measures make the CVV code an indispensable tool in the fight against financial fraud. As we move forward, let's compare the CVV codes across different card providers.

Differences Between CVV Codes Across Card Providers

While all major card providers use CVV codes, there are notable differences in their implementation. American Express, Visa, and MasterCard each have their own unique approach to this security feature, which users should be aware of.

For instance, Visa and MasterCard typically use three-digit CVV codes located on the back of the card, while American Express employs a four-digit CID on the front. These variations reflect the distinct strategies employed by each provider to enhance security and user experience.

Comparison of CVV Codes

| Card Provider | CVV Code Length | Location |

|---|---|---|

| American Express | 4 digits | Front of the card |

| Visa | 3 digits | Back of the card |

| MasterCard | 3 digits | Back of the card |

This table highlights the key differences between CVV codes across major card providers, helping users better understand how to use them effectively.

How to Use CVV Code Safely

Using the CVV code safely is crucial for maintaining the security of your financial information. Here are some best practices to follow when providing your CVV code during transactions:

- Never share your CVV code with anyone, even if they claim to be from your bank or a merchant.

- Only enter the CVV code on secure websites that use HTTPS encryption.

- Be cautious of phishing attempts and verify the legitimacy of websites before entering your details.

By adhering to these guidelines, you can minimize the risk of fraud and protect your financial data. Next, let's discuss how to avoid CVV fraud altogether.

Tips to Avoid CVV Fraud

CVV fraud is a growing concern in the digital age, but there are steps you can take to mitigate the risk. Awareness and vigilance are key to staying safe in the online payment environment. Here are some practical tips to help you avoid CVV fraud:

- Regularly monitor your bank statements for suspicious activity.

- Enable two-factor authentication for your online accounts.

- Use virtual card numbers for online purchases to protect your actual card information.

Implementing these strategies can significantly reduce the likelihood of falling victim to CVV fraud. As technology continues to evolve, staying informed about the latest security measures is essential.

Common Questions About CVV Code American Express

Many users have questions about the CVV code American Express, ranging from its location to its functionality. Below are some frequently asked questions and their answers:

FAQs

- Q: Is the CVV code the same as the PIN? No, the CVV code is used for online transactions, while the PIN is required for in-person purchases at ATMs or point-of-sale terminals.

- Q: Can the CVV code be replaced if lost or stolen? Yes, contacting your bank or card issuer can help you replace the CVV code if necessary.

- Q: Is the CVV code stored by merchants? No, merchants are prohibited from storing the CVV code after a transaction for security reasons.

These answers address common concerns and clarify misconceptions about the CVV code American Express. Let's now look ahead to the future of CVV technology.

The Future of CVV Technology

As technology advances, so do the methods used to protect financial transactions. The future of CVV technology may include dynamic CVV codes that change with each transaction, further enhancing security. Biometric authentication and tokenization are also emerging as promising solutions in the fight against fraud.

Staying updated on these developments is essential for users who want to ensure their financial information remains secure. By embracing new technologies and adhering to best practices, we can all contribute to a safer payment ecosystem.

Conclusion

In conclusion, understanding the CVV code American Express is vital for secure and hassle-free transactions. From its unique four-digit format to its strategic placement on the card, the CVV code plays a crucial role in verifying cardholder identity and preventing fraud. By following the tips and best practices outlined in this guide, you can use your American Express card with confidence and peace of mind.

We encourage you to share this article with others and explore more resources on our website to enhance your knowledge of financial security. Your feedback and questions are always welcome in the comments section below. Together, let's promote a safer and more informed financial community.

Sources:

- American Express Official Website

- PCI Security Standards Council

- Federal Trade Commission

![American Express CID (CVV) Code Guide [2022] UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2021/03/Platinum-Card-CID.jpg)