Can You Pay Car Payment With Credit Card: A Comprehensive Guide

Paying your car payment with a credit card has become a popular option for many individuals seeking flexibility and rewards. If you're wondering whether this method is right for you, it's essential to understand the ins and outs of using credit cards for car payments. This article will provide a detailed exploration of the topic, including the benefits, drawbacks, and best practices.

As more financial institutions embrace digital payment methods, the ability to pay car payments with credit cards is becoming increasingly accessible. However, it's crucial to weigh the pros and cons to avoid potential pitfalls. Understanding how this process works can help you make informed financial decisions.

Whether you're looking to earn rewards points, manage cash flow, or take advantage of promotional offers, paying your car payment with a credit card might be worth considering. Dive deeper into this article to explore everything you need to know about this payment method and determine if it aligns with your financial goals.

Read also:Ali Andreea Net Worth Unveiling The Financial Empire Behind The Global Superstar

Table of Contents

- Introduction

- Can You Pay Car Payment with Credit Card?

- Benefits of Paying Car Payment with Credit Card

- Drawbacks of Paying Car Payment with Credit Card

- How to Pay Car Payment with Credit Card

- Fees Associated with Credit Card Car Payments

- Credit Card Rewards for Car Payments

- Best Credit Cards for Paying Car Payments

- Tips for Paying Car Payment with Credit Card

- Frequently Asked Questions

- Conclusion

Can You Pay Car Payment with Credit Card?

Yes, you can pay car payments with a credit card, but it depends on your lender's policies. Many lenders allow this method, either directly or through third-party payment processors. However, it's essential to check with your lender beforehand to ensure they accept credit card payments and understand any associated fees.

Some lenders may impose restrictions or charge processing fees, so it's wise to review the terms and conditions. Additionally, not all credit cards are accepted, so confirm which cards your lender supports.

Why Consider Paying with Credit Card?

Using a credit card for car payments can offer several advantages, such as earning rewards points, extending cash flow, and taking advantage of promotional offers. However, it's important to assess whether the benefits outweigh the potential costs.

Benefits of Paying Car Payment with Credit Card

Paying your car payment with a credit card can provide numerous benefits, depending on your financial situation and credit card usage habits. Below are some key advantages:

- Rewards Points: Many credit cards offer rewards programs that allow you to earn points, miles, or cash back for every dollar spent. Using your card for car payments can help you accumulate these rewards faster.

- Promotional Offers: Some credit cards offer 0% introductory APRs on purchases or balance transfers, allowing you to defer interest payments for a specified period.

- Cash Flow Management: Paying with a credit card gives you more time to manage your cash flow, as you can delay payment until the card's billing cycle ends.

Additional Benefits

Credit cards also offer purchase protection, extended warranties, and fraud protection, adding an extra layer of security to your car payments.

Drawbacks of Paying Car Payment with Credit Card

While there are benefits to paying car payments with a credit card, there are also potential drawbacks to consider:

Read also:Undressai A Comprehensive Guide To Privacy Ethics And Technological Innovation

- Processing Fees: Lenders may charge a convenience fee for using a credit card, which can range from 2% to 4% of the payment amount.

- High Interest Rates: If you don't pay off your credit card balance in full each month, you could incur high interest charges, making the payment more expensive in the long run.

- Credit Utilization: Large car payments can increase your credit utilization ratio, potentially negatively impacting your credit score.

How to Mitigate the Drawbacks

To minimize the drawbacks, consider using a credit card with a low or no processing fee policy, paying off the balance in full each month, and monitoring your credit utilization ratio.

How to Pay Car Payment with Credit Card

Paying your car payment with a credit card involves a few straightforward steps:

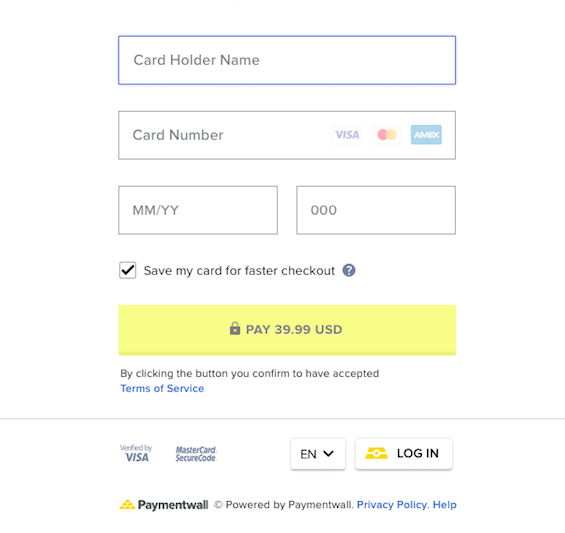

- Contact Your Lender: Verify whether your lender accepts credit card payments and which cards they support.

- Set Up Payment Method: Update your payment method in your lender's online portal or mobile app to include your credit card.

- Review Terms and Fees: Check for any processing fees or restrictions before proceeding with the payment.

Alternative Payment Methods

If your lender doesn't accept credit cards directly, consider using third-party payment processors or apps that facilitate credit card payments for a fee.

Fees Associated with Credit Card Car Payments

When paying car payments with a credit card, it's important to be aware of any associated fees:

- Convenience Fees: Lenders may charge a fee for using a credit card, typically a percentage of the payment amount.

- Third-Party Processor Fees: If you use a third-party service, they may also charge a fee for facilitating the transaction.

According to a study by the Federal Reserve, convenience fees for credit card payments average around 2.5% of the transaction amount. Always factor these fees into your budget to avoid unexpected costs.

Ways to Avoid Fees

Some credit cards offer fee waivers for specific types of transactions, so check with your card issuer for any available promotions or discounts.

Credit Card Rewards for Car Payments

Using a credit card for car payments can help you earn valuable rewards, such as:

- Cash Back: Many cards offer cash back rewards, allowing you to earn a percentage of your payment as cash rewards.

- Travel Points: Travel-focused credit cards may offer points or miles for every dollar spent, which can be redeemed for flights, hotels, or other travel expenses.

- Statement Credits: Some cards offer statement credits for specific purchases, reducing your overall balance.

Maximizing Your Rewards

To maximize your rewards, choose a credit card with a rewards program that aligns with your spending habits and financial goals.

Best Credit Cards for Paying Car Payments

Several credit cards are particularly well-suited for paying car payments. Below are some top options:

- Chase Sapphire Preferred: Offers 2x points on travel and dining, with no foreign transaction fees.

- Capital One Venture Rewards: Provides 2x miles on every purchase, with a generous sign-up bonus.

- Bank of America Premium Rewards: Offers 3x points on travel, with additional benefits for Bank of America account holders.

Research each card's features, benefits, and fees to determine which one best suits your needs.

Evaluating Credit Card Options

Consider factors such as rewards structure, annual fees, and interest rates when evaluating credit card options for car payments.

Tips for Paying Car Payment with Credit Card

To make the most of paying your car payment with a credit card, follow these tips:

- Pay Off the Balance Monthly: Avoid interest charges by paying off your credit card balance in full each month.

- Monitor Fees: Keep track of any processing fees and factor them into your budget.

- Track Rewards: Regularly check your rewards program to ensure you're maximizing your benefits.

Staying Financially Responsible

Maintain financial discipline by using credit cards responsibly and avoiding unnecessary debt accumulation.

Frequently Asked Questions

Can All Credit Cards Be Used for Car Payments?

No, not all credit cards are accepted for car payments. Check with your lender to confirm which cards they support.

Are There Any Risks Involved?

Yes, risks include high interest rates, processing fees, and potential negative impacts on your credit score if not managed properly.

What Happens If I Don't Pay Off the Balance?

If you don't pay off your credit card balance in full, you'll incur interest charges, which can increase the overall cost of your car payment.

Conclusion

Paying your car payment with a credit card can offer significant benefits, such as earning rewards points, managing cash flow, and taking advantage of promotional offers. However, it's essential to weigh the potential drawbacks, including processing fees and high interest rates. By following the tips outlined in this article and choosing the right credit card, you can make informed financial decisions that align with your goals.

We encourage you to share your thoughts and experiences in the comments below. For more financial insights, explore our other articles and stay updated on the latest trends in personal finance.